What does Accounts Receivable mean and how does it work?

Within business finance, the term “Accounts Receivable” (AR) is one you’ll encounter frequently. But what exactly does it mean for you and your business? Many find it to be a puzzling concept, but understanding it is crucial to managing your company’s finances effectively. We’re here to help you understand exactly what it means and how it can be applied to your business’s finances.

What are Accounts Receivable?

Accounts receivable, in their simplest form, is the money that clients owe to a company. It manifests when a business has delivered goods or services but hasn’t yet received payment. In other words, it’s the money that your customers owe you for goods or services you’ve provided on credit.

For instance, if your business sells software solutions to a client and you provide them with a 30-day payment term, the invoice you issue becomes part of your accounts receivable until the client pays it.

In your company’s balance sheet, accounts receivable is registered as an asset. It signifies a future amount of cash that you expect to receive. On the other side of the balance sheet, there is accounts payable. This refers to the outgoing payments from your business to vendors or suppliers. Accounts receivable is what you will be receiving in payments, and accounts payable is what you will be paying out.

How Do Accounts Receivable Work?

The process of AR typically involves the following steps:

Sale of Goods or Services

The process begins when you sell goods or services to a customer on credit, meaning they’ll pay you at a later date, such as in 30 days, 60 days or any agreed-upon time frame.

Invoice Issuance

After the sale, you’ll need to issue an invoice to the customer, detailing the amount they owe and when payment is due.

Recording the Receivable

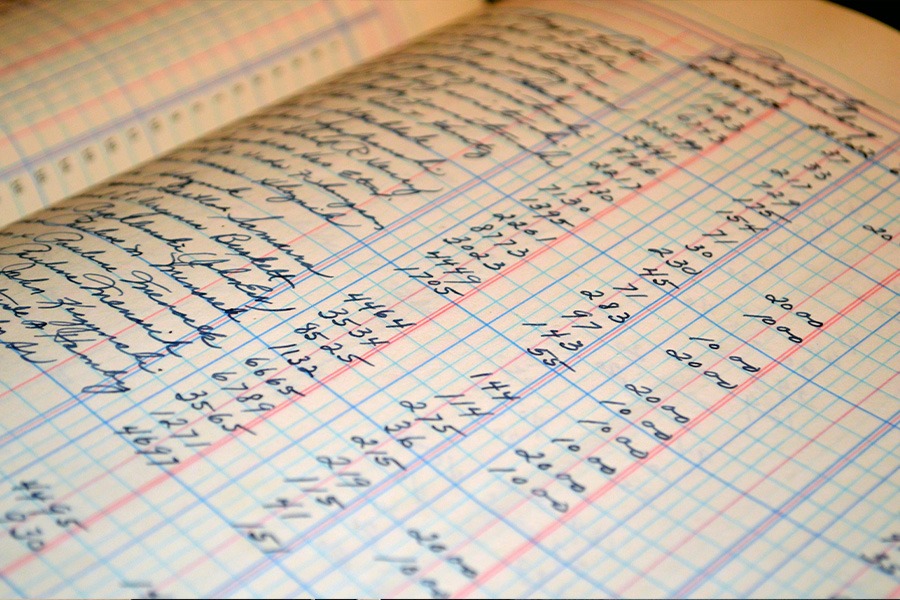

The invoice amount is recorded as accounts receivable in your accounting books until payment is received.

Payment Collection

The customer pays their invoice by the due date, and the amount in accounts receivable is reduced by the payment amount.

Late or Non-Payment Follow-up

If the payment is late or not received, further actions are needed. As per the UK late payment legislation, you have the right to claim interest and debt recovery costs if another business is late in paying for goods or services.

Why is Accounts Receivable Important?

Cash Flow Management

Efficient AR management ensures a steady cash inflow that can be used for operational expenses.

Customer Creditworthiness

Monitoring AR can help you assess your customer’s creditworthiness. If a customer frequently pays late, you might need to revise their credit terms or seek payment upfront in future transactions.

Financial Analysis

AR is a key factor in various financial analysis ratios, including the accounts receivable turnover ratio, which can provide insights into how effectively you’re managing your cash flow and balancing your books.

Why use a Bookkeeper to manage your Accounts Receivable?

Proper management of your financial books is paramount to maintaining healthy cash flow and ensuring your business’s financial stability. However, it can be time-consuming and complex. This is where professional bookkeepers like CPL Accounts come in. We can help manage your AR and AP, ensuring timely invoicing and follow-ups, and providing you with accurate financial reporting.

In conclusion, while accounts receivable might seem like a complex concept, it’s a key part of managing your business’s finances. By understanding what it is and how it works, you’ll be better equipped to manage your cash flow and maintain a healthy financial position.

For more information on how CPL Accounts can help you balance your books and keep track of your accounts, get in touch today!