The Backbone of Business: Understanding the Roles and Benefits of a Bookkeeper

Accurate financial management is the key to success and longevity. This is where a bookkeeper comes into play. Often overlooked, a bookkeeper’s role is critical in maintaining the financial health of a business. Let’s delve into the roles and benefits of a bookkeeper and why your business might just need one.

The Role of a Bookkeeper: More Than Just Numbers

A bookkeeper is much more than a number cruncher. They are the custodians of a business’s financial data, ensuring every financial transaction is recorded accurately and categorised correctly.

Keeping Track of Transactions

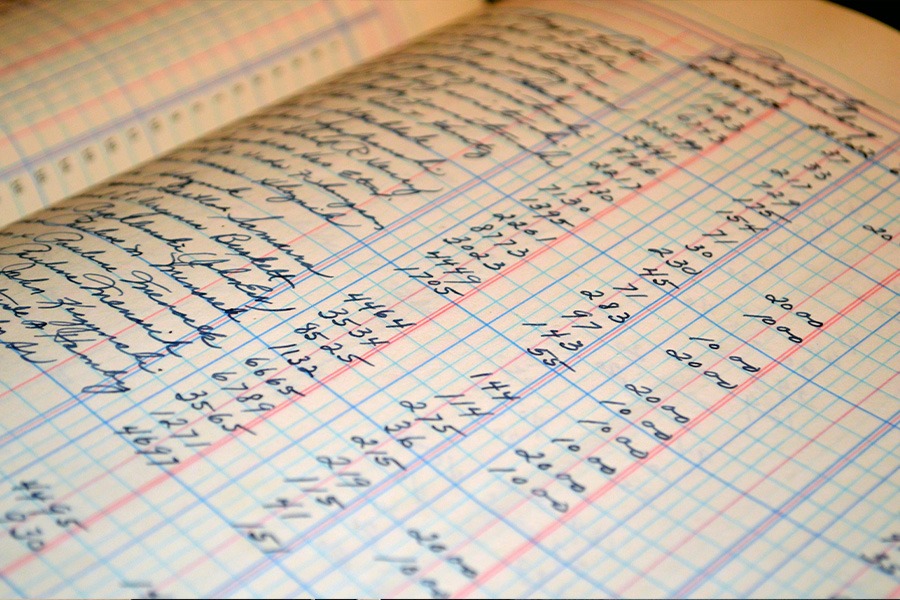

One of the primary duties of a bookkeeper is to record and categorise all financial transactions. This includes sales, purchases, income and payments. By accurately logging these transactions, a bookkeeper lays the groundwork for the financial management of a business.

Managing Accounts Payable and Receivable

A bookkeeper manages the accounts payable and receivable. This involves sending invoices, ensuring timely payments and keeping track of any outstanding debts. On the flip side, they also manage payments for expenses incurred by the business, ensuring bills are paid on time and logged correctly.

Preparing Financial Statements

Bookkeepers play a crucial role in preparing financial statements. These statements, including income statements, balance sheets and cash flow statements, provide a snapshot of the financial health of the business.

The Benefits of a Bookkeeper

Now that we understand the roles of a bookkeeper, let’s explore the benefits they bring to a business.

Accurate Financial Data

Having a bookkeeper ensures that your financial data is accurate and up-to-date. This is crucial for making informed business decisions. Whether you’re considering a new investment or planning for the future, you can rely on your bookkeeper’s records.

Time-Saving

Bookkeeping can be a time-consuming task, especially for small business owners who wear many hats. Having a dedicated bookkeeper saves you time that you can spend on other aspects of your business.

Compliance and Peace of Mind

A bookkeeper ensures you’re compliant with tax laws and other financial regulations. They keep track of deadlines, prepare required documentation and make sure your financial activities are above board. This peace of mind alone is worth its weight in gold!

Financial Analysis and Advice

While it’s not their primary role, some bookkeepers may also provide basic financial analysis and advice. They can help you understand your cash flow, profit margins and other financial metrics, which can steer your business in the right direction.

Cost Savings

Believe it or not, a good bookkeeper can save your business money. By keeping track of invoices and expenses, they can help manage cash flow and avoid late fees. They may also spot areas where you could cut costs.

The role of a bookkeeper extends beyond mere number crunching. They accurately record and manage financial data, prepare financial statements and ensure compliance with financial regulations. The benefits they bring to a business – accurate financial data, time-saving, compliance, financial advice and cost savings – make them an invaluable asset.

If you’re ready to reap these benefits, consider hiring a bookkeeper for your business. It’s not just an expense; it’s an investment in your business’s financial health and success. Contact us today to find out how our bookkeeping services can help you grow your business.

Remember, behind every successful business is a dedicated bookkeeper!