A Guide to Submitting your Self-Assessment Tax Return Before the Deadline

The end of the tax year brings the annual responsibility of filing your self-assessment tax return. While the process may seem daunting, a timely submission is crucial to avoid penalties and ensure financial compliance.

It is important to note that all self-employed individuals, freelancers and small business owners must complete and submit a self-assessment to HMRC.

But fear not, we’re here to guide you through the steps to submit your self-assessment tax return with confidence before the looming deadline.

Know Your Deadline

The first step to a stress-free tax season is understanding when your self-assessment tax return is due. The deadline in the UK is January 31st for the previous tax year.

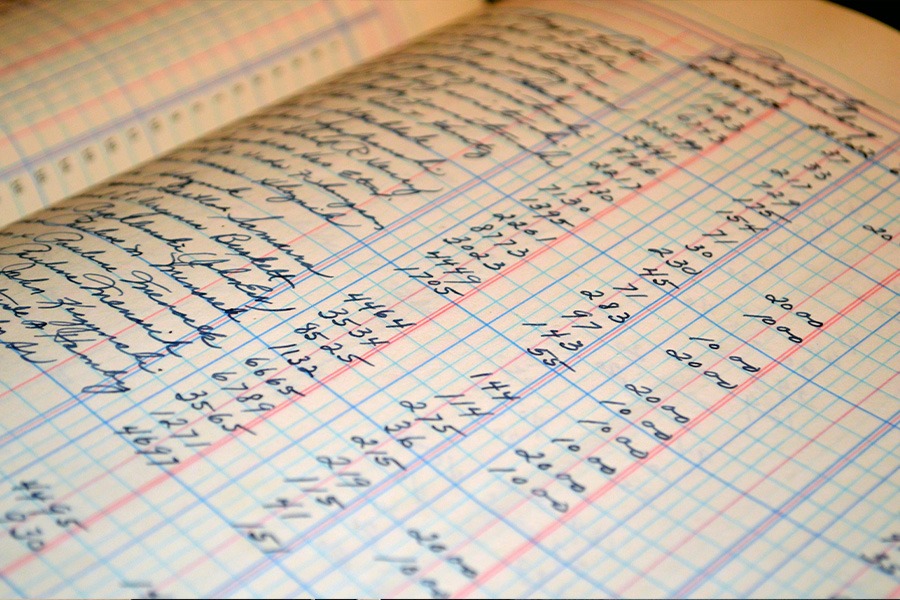

Gather Your Documents

Ensure you have all the necessary documents at your fingertips. This includes income statements, receipts, and records of any expenses. Being organised from the outset will save you time and minimise the chance of errors.

Update Personal Information

Before diving into the forms, check that your personal information is up-to-date. Changes in address, employment, or marital status should be reflected accurately in your self-assessment.

Use the Online Tools

Take advantage of online tools and resources provided by tax authorities.

Seek Professional Advice

If you find the process overwhelming or have complex financial situations, consider seeking professional advice. Here at CPL Accounts we’re happy to help and can provide valuable insights, ensure compliance, and identify opportunities for savings.

Double-Check for Accuracy

Accuracy is key when submitting your self-assessment. Double-check all figures, ensuring that income and expenses are correctly recorded. Mistakes can lead to delays and potential penalties.

Claim Eligible Deductions

Don’t miss out on eligible deductions. Take the time to understand which expenses can be claimed to reduce your tax liability. This may include business expenses, charitable donations, or other allowable deductions.

Save Your Progress

Most online platforms allow you to save your progress, enabling you to complete your self-assessment in stages. Take advantage of this feature to review your entries and make any necessary adjustments before the final submission.

Budget for Payments

If you anticipate owing taxes, budget accordingly. Planning for any payments owed ensures that you won’t be caught off guard and can avoid late payment penalties.

Submit Early

While the deadline may be at the end of January, aim to submit your self-assessment well before this date. Submitting early not only eliminates the stress of last-minute rushes but also provides a buffer in case any issues arise that need addressing.

Filing your self-assessment tax return doesn’t have to be a daunting task. By staying organised, leveraging online resources, and seeking professional advice when needed, you can navigate the process with confidence. Remember, the key is to start early, be thorough, and submit well before the deadline to ensure a smooth and penalty-free experience. Taking control of your financial responsibilities sets the tone for a successful and stress-free tax season.