Basic Bookkeeping: the Difference between a Bookkeeper and an Accountant

In the realm of business finance, two roles often take centre stage: bookkeepers and accountants. Both are indispensable for the seamless operation of a business’s financial affairs. However, many entrepreneurs and small business owners in the UK often ask about the difference between the two. Although their work can sometimes overlap, bookkeeping and accounting are separate disciplines, each with its unique functions and value.

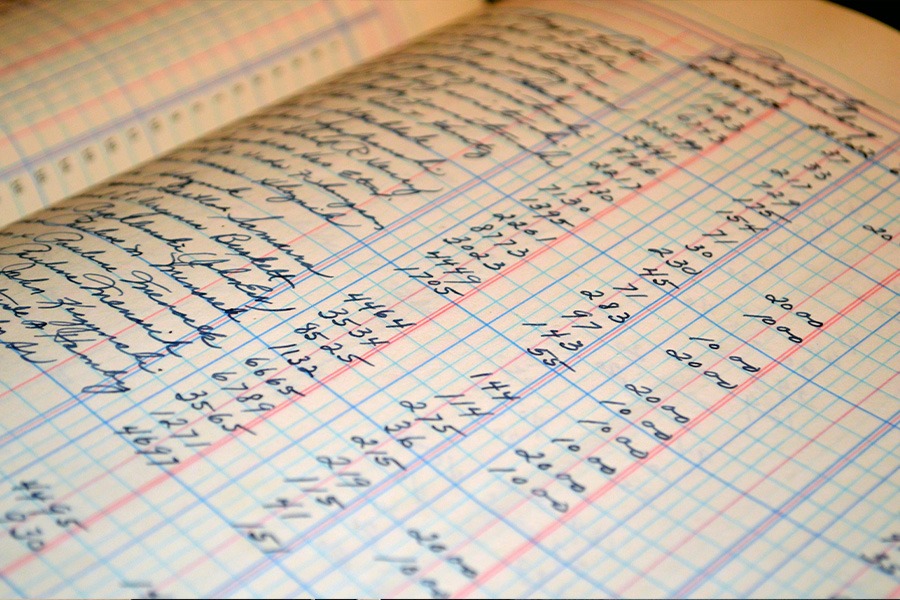

What is involved in basic Bookkeeping?

Bookkeeping, at its most basic level, is the process of recording a company’s financial transactions. It’s the first and arguably the most vital step in the financial management process. Without precise bookkeeping, there is the potential for all other financial operations to be flawed.

At CPL accounts bookkeeping, our basic duties include, maintaining a general ledger, recording all transactions, and ensuring that debits equal credits. We also offer other services to our clients such as payroll, VAT registration, Financial Management, management accounts and the Construction Industry Scheme (CIS)

The discipline of bookkeeping provides a company with the raw data required to gain an overall picture of its financial health.

The Role of an Accountant

Now, let’s consider the accountant. While a bookkeeper records financial transactions, an accountant’s role is to interpret, classify, analyse, report, and summarise this financial data. Accountants take the bookkeeping data and use it to create financial models, perform audits, and prepare financial statements. They also provide strategic advice, helping businesses understand the financial impact of decisions and plans.

Bookkeeper vs. Accountant: The Key Differences

While both bookkeepers and accountants work with financial data, the key difference between the two lies in the level of analysis and advisory. A bookkeeper’s job is to ensure accurate record keeping of financial transactions, while an accountant’s role involves a more detailed analysis and interpretation of those records.

Bookkeepers lay the groundwork, while accountants build on that foundation to provide strategic insight, tax planning, and financial forecasting.

Why Both are Important

Both roles are critical for the financial health of a company. Efficient bookkeeping ensures accurate financial records, which are then used by accountants for detailed financial analysis. Both roles complement each other and together provide a complete picture of a company’s financial status, informing strategic decisions and future planning.

In conclusion, while the roles of a bookkeeper and an accountant may seem similar, they each serve a unique purpose within a business’s financial infrastructure, and one does not always need to be used in conjunction with the other. Understanding the difference can help businesses effectively manage their financial operations, leading to better financial health and strategic planning.

If you’d like help with your bookkeeping, whether it’s keeping track of your transactions or going through your old box of receipts, CPL Accounts is happy to help with a variety of services.