Budgeting for the New Tax Year

As the new tax year rolls around, it’s time for businesses across the UK to reassess their financial plans and prepare for the future. Meaning that now is a crucial time for business owners to get their finances and yearly budgets in order. At CPL Accounts we work closely with businesses in doing their VAT returns and support customers in completing and submitting a tax return to HMRC. Our Finance managing services also allow us to work closely with clients to allow us to put together financial reports and forecast future cash flow. This is why we’ve put together a short plan for businesses on budgeting for the new tax year.

Understanding the Tax Landscape

The first step in preparing for the new tax year is to familiarise yourself with any changes in tax laws or regulations. These could include updates to personal allowances, changes in tax rates or thresholds, or alterations to reliefs and deductions. Staying informed about these changes will ensure that your budgeting is accurate and compliant.

Reflecting on the Previous Year

Before you can plan for the future, it’s important to reflect on the past. Review your budget from the previous year, noting what worked well and where there might be room for improvement. This will give you a clear picture of your financial health and provide a baseline for planning your budget for the new tax year.

Setting Financial Goals

Once you have a clear understanding of your financial position, it’s time to set your goals for the new tax year. Are you looking to grow your business, save for a significant purchase, or reduce your tax liability? Your financial goals will shape your budget and influence your financial decisions throughout the year.

Creating a Budget

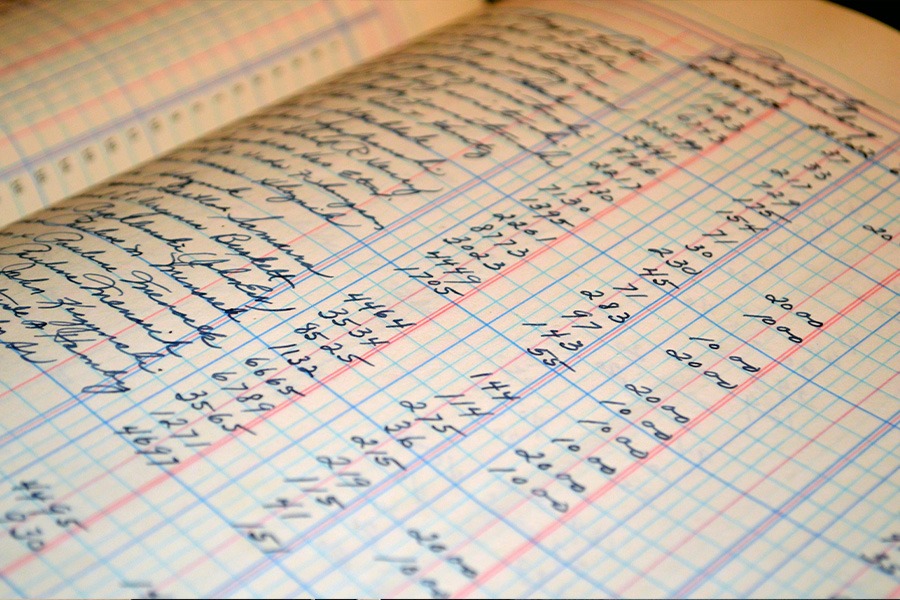

With your financial goals in mind, you can begin to create a budget for the new tax year. This should include all anticipated income and expenses, including business costs, living expenses, and discretionary spending.

While creating your budget, it’s also crucial to consider potential tax liabilities. Make sure to set aside funds to cover expected tax payments, and consider strategies to minimise tax liabilities, such as taking advantage of tax-free allowances, tax relief on pension contributions, and capital gains tax allowances.

Regular Monitoring and Adjustments

Budgeting isn’t a one-time task. It’s essential to regularly monitor your budget throughout the year and make adjustments as necessary. This could involve updating your budget to reflect changes in income or expenses, adjusting projected tax liabilities based on actual earnings, or re-evaluating your financial goals.

Compliance is Key

Lastly, it’s crucial to ensure that you stay compliant with tax laws and regulations. This includes timely filing of tax returns and payment of any due taxes. Maintaining compliance will help you avoid penalties and keep your business in good standing with HM Revenue and Customs (HMRC).

Conclusion

The new tax year is a golden opportunity to reassess your financial plans and prepare for the future. By understanding the tax landscape, reflecting on the previous year, setting financial goals, creating a robust budget, and ensuring compliance, you can navigate the new tax year with confidence.

At CPL Accounts we understand that managing all these tasks can be overwhelming, especially when you’re trying to run a business. That’s why we’re here to help. Our team of experienced bookkeepers can assist you with day-to-day bookkeeping and even managing your accounts, helping you put together yearly and quarterly reports alongside predicting cash flow. Contact us today to learn more about how we can help your business thrive in the new tax year.