Double-Entry Bookkeeping vs Single-Entry Bookkeeping

Double-Entry Bookkeeping and Single-Entry Bookkeeping. What’s the difference? Both have their merits and drawbacks. And their suitability can vary depending on the size, complexity and specific needs of a business.

Here at CPL Accounts, we know that not every SME needs Double entry bookkeeping. Sometimes you just need someone to look after your chequebook. We’re happy to help you out in whichever way you need and point you in the right direction if you’re not sure. This article aims to explore these two systems, highlighting their differences, advantages and disadvantages, to help you make an informed decision on what you need for your business.

Single-Entry Bookkeeping: Simplicity and Ease

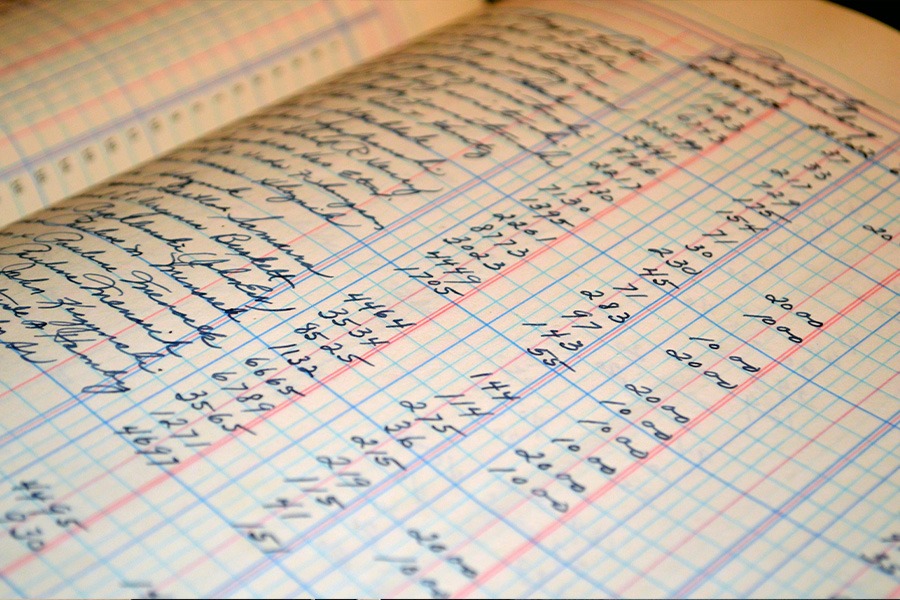

Single-entry bookkeeping is a straightforward, simple system that is essentially like keeping a chequebook register. Each transaction is recorded once, either as income or expense. It’s a system which is the ideal choice for small businesses, sole traders, and freelancers who do not have a significant volume of transactions.

The primary advantage of single-entry bookkeeping is its simplicity. However, this simplicity comes with limitations. The system does not provide a comprehensive view of the company’s financial health as it does not track assets or liabilities. It also lacks the self-balancing aspect of double-entry bookkeeping, making errors harder to spot.

Double-Entry Bookkeeping: Comprehensive and Accurate

Double-entry bookkeeping, on the other hand, is a more complex system where each transaction is recorded twice – once as a debit and once as a credit in two different accounts. This system provides a complete picture of a business’s financial situation, tracking not only income and expenses but also assets, liabilities, and equity.

The primary advantage of this type of bookkeeping is its accuracy and comprehensiveness. It provides a detailed record of all financial transactions, allowing for in-depth financial analysis and facilitating more accurate financial reporting. The system is self-balancing, meaning that if all transactions are recorded correctly, the total debit amount should equal the total credit amount, making it easier to spot errors or discrepancies.

Which system should you choose?

The decision between single-entry and double-entry bookkeeping ultimately depends on your business’s needs. If your operations are simple with a small number of transactions, single-entry bookkeeping might suffice. However, if your business has a significant volume of transactions, multiple assets and liabilities, or you require detailed financial reports, double-entry bookkeeping is the recommended choice.

In conclusion, both single-entry and double-entry bookkeeping have their place within the business environment. Understanding their differences and applications can help business owners select the most appropriate system for their needs, leading to more accurate and effective financial management. CPL Accounts is more than happy to help guide you through the options available to your business and help you find the solutions you need for your bookkeeping. Get in touch today to find out more!