Navigating Seasonal Cash Flow Fluctuations

In many businesses, there is a seasonal cash flow, whether you’re a bar and restaurant hospitality business, a digital agency or a ski resort. Some may have more obvious cash flows than others, but there are always times of year when business is more popular than others. It is therefore essential to be able to manage your cash flow within your business.

Understanding Seasonal Cash Flow

Seasonal cash flow refers to the pattern of cash inflows and outflows that a business experiences throughout the year due to seasonal trends. This fluctuation affects their cash flow and can pose significant challenges.

For many businesses, it’s summer and winter (specifically Christmas) when there is the biggest increase in cash flow. As summer has officially started, the hospitality and leisure industry is likely to see an influx over the coming months.

We’ve put together this list to help small businesses manage their seasonal cash flow better, and become more financially stable from it. This is just a simple guide to help you better understand how to manage the cash flow of your business. For more information on how you can better help your business and strategically manage your business’s cash flow throughout the year, get in touch with CPL Accounts.

Strategies for Managing Seasonal Cash Flow

Budgeting and Forecasting

Use your historical sales and expense data to create a budget and cash flow forecast. This will help you anticipate your cash needs and make adjustments as necessary.

Broaden your Range

Consider diversifying your products or services to generate income during slow seasons. If diversification isn’t an option, think about other ways to boost revenue, such as offering off-season discounts or exploring new markets.

Negotiate with Suppliers

If you have a good relationship with your suppliers, consider negotiating better payment terms during your slow season to ease cash flow pressure.

Build a Cash Reserve

Use your surplus cash during peak seasons to build a cash reserve. This reserve can provide a financial cushion during lean periods and help you meet your financial obligations.

Consider Seasonal Financing

Some lenders offer seasonal lines of credit designed to help businesses with seasonal cash flow. This type of financing can provide the extra cash you need to bridge the gap during slow periods.

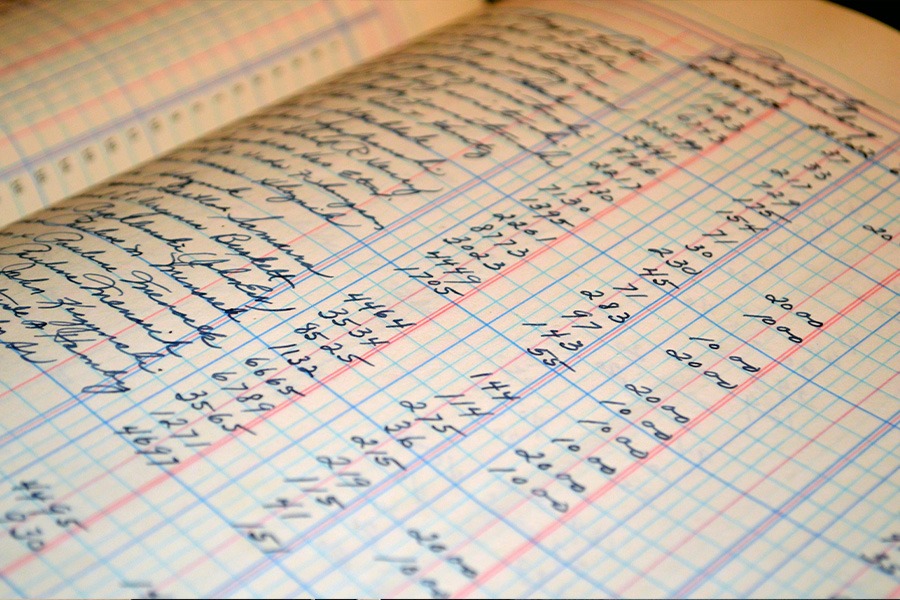

How professional bookkeeping services can help

Identifying Cash Flow Patterns

Bookkeeping helps identify when your cash inflows and outflows occur. Bookkeepers analyse your financial records, and can help you pinpoint when you make the most sales and when you incur the most expenses. This information can guide your budgeting and forecasting, helping you prepare for quiet periods.

Informing Inventory Management

Managing inventory is a balancing act. You want to have enough stock to meet demand during peak seasons but not so much that you have excess inventory during slow periods. Your bookkeeping records can guide your purchasing decisions, helping you align your inventory levels with anticipated sales.

Facilitating Access to Financing

There may be times when you need external financing to cover short-term cash shortfalls. Lenders and investors will want to see your financial records before they commit any funds. Keeping accurate and up-to-date books through professional bookkeepers can make it easier for you to secure the financing you need.

Hopefully this blog has been able to help you look into new ways to help manage your cash flow and its seasonality. We always recommend using professional bookkeeping services to help manage your books and keep you up to date on the ins and outs of your business and better maintain your cash flow. For more information, don’t be afraid to reach out to CPL Accounts to see how we can help you and your business manage your cash flow through maintaining your bookkeeping records.