Understanding Your Financial Statements: A Guide for Small Business Owners

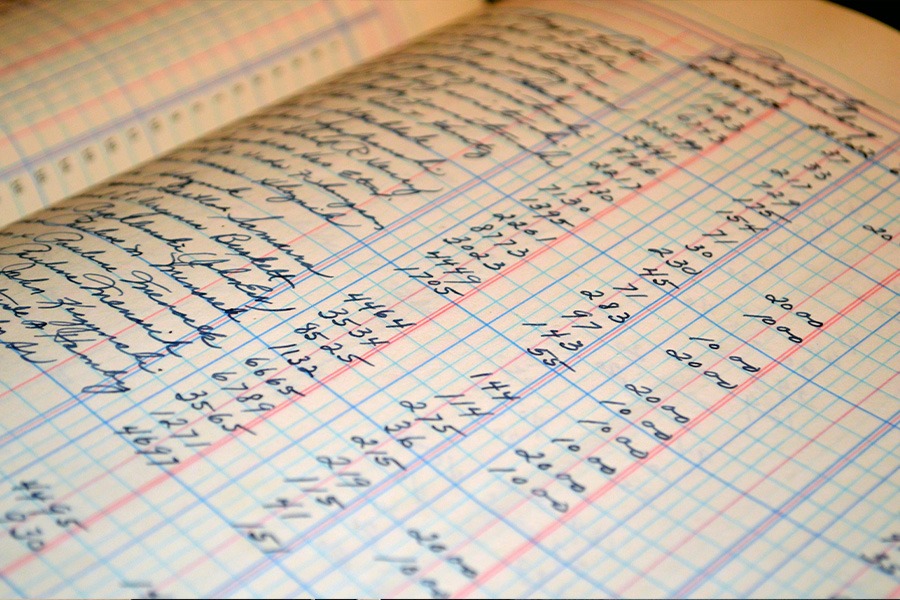

As a small business owner, you’re used to juggling various responsibilities. From marketing, sales, customer service and even bookkeeping. One critical aspect of managing your business well is understanding your financial statements. These documents are pivotal in monitoring your progress, making strategic business decisions, and securing loans or investments, and most of these are generated from your bookkeeping records.

We’re here to guide you through what these financial statements are, and explains how to interpret them.

What are Financial Statements?

Financial statements provide a snapshot of your business’s financial activities over a specific period. The three primary financial statements are the Balance sheet, the Income Statement, and the Statement of Cash Flows. These reports are all generated from your bookkeeping records and highlight the importance of keeping accurate bookkeeping.

Balance Sheet

The balance sheet, provides a snapshot of your business’s financial health at a specific point in time. It’s divided into three parts: assets, liabilities, and capital (or equity).

- Assets comprise everything your business owns – cash, accounts receivable, inventory, property, equipment, etc.

- Liabilities are what your business owes – loans, accounts payable, wages payable, taxes payable, etc.

- Capital, also known as equity, is the residual interest in the assets of the entity after deducting liabilities. It’s essentially your stake in the business.

The fundamental equation for a balance sheet is: Assets = Liabilities + Capital.

Balance sheets provide insight into your company’s financial standing and show information that is key to assessing a business’s past, current, and future performance. Banks and Investors will often look into the balance sheets before investing or lending money as it gives a good indication into the financial health of your business.

Income Statement

The income statement, illustrates your business’s profitability over a specific period. It lists your income, costs, and expenses to calculate a net profit or loss figure.

- Income refers to the earnings your business makes from its core operations, often from selling goods or services.

- Costs and Expenses are the expenditures incurred to generate the income. They include cost of goods sold, operating expenses (like salaries, rent, utilities), and taxes.

- Net Profit or Loss is the bottom line. It’s what’s left after deducting all expenses from your income. If this figure is positive, your business is profitable. If it’s negative, your business is operating at a loss.

The income statement is a good way to measure the success of your business, and the strategies you’ve set in place over the year.

Statement of Cash Flows

The Statement of Cash Flows outlines the movement of cash into and out of your business over a set period. It’s divided into three sections: cash flows from operating activities, investing activities, and financing activities.

- Operating activities include cash received from sales and cash paid for operating expenses.

- Investing activities involve buying and selling assets like equipment and property.

- Financing activities include borrowing from a bank and repaying loans, or issuing and buying back company shares.

Understanding the Statement of Cash Flows is vital because it shows how well your business can generate cash to pay debts and sustain its operations.

Understanding these financial statements is key to making informed decisions for your business. They provide you with the insight to identify trends, anticipate potential challenges, and seize opportunities for growth. They all start with well managed bookkeeping. Here at CPL Accounts we specialise in bookkeeping and can assist you in making sure everything is in order for these financial reports, whilst you focus on your business. Get in touch with CPL Accounts today to see how we can help.